Rare earth market update on July 8, 2025

On July 8, 2025, the domestic rare earth market is performing well, with prices of mainstream light and heavy rare earth products rising to varying degrees. Neodymium oxide prices have increased by approximately 3,000 yuan/ton, terbium oxide by about 60 yuan/kg, and holmium oxide by around 5,000 yuan/ton. Under these conditions, prices of rare earth permanent magnet materials and their scraps have also risen, with 55N neodymium-iron-boron blank blocks up by about 2 yuan/kg and neodymium-iron-boron scrap (terbium) by approximately 55 yuan/kg. However, the sustainability of this price surge requires further market validation.

Bullish Factors:

Stricter environmental enforcement and weak prior market conditions have led some rare earth separation enterprises to reduce output, tightening spot market supply.

Elevated geopolitical risks, high overseas rare earth prices, and moderate purchasing power of the yuan have limited China’s rare earth imports; recent fighting in Myanmar may further impact local rare earth exports.

With reduced low-priced supply and ongoing production demand, buyer inquiries have become more active; July and August mark the peak consumption season for rare earth permanent magnet materials.

Renewed expectations of tariff disputes have further highlighted the strategic value of rare earths.

Bearish Factors:

In the context of a complex global economic landscape and tight market funding, downstream users remain cautious in their consumption.

News Updates: According to CCTV News, on July 7, 2025, the United States issued letters to Indonesia, Bosnia and Herzegovina, Bangladesh, Serbia, Cambodia, Thailand, and Tunisia, announcing that starting August 1, 2025, it will impose a 32% tariff on all Indonesian products exported to the U.S., 30% on Bosnian products, 35% on Bangladeshi and Serbian products, 36% on Cambodian and Thai products, and 25% on Tunisian products. Additionally, starting the same date, the U.S. will apply a 25% tariff on products from Kazakhstan and Malaysia, 30% on South African products, and 40% on products from Laos and Myanmar, independent of industry-specific tariffs. Efforts to evade these tariffs through third-country transshipment will incur higher penalties, while companies opting to build or produce in the U.S. will be exempt. Furthermore, if these countries raise tariffs on U.S. goods, the U.S. will add equivalent tariff increases on top of the existing rates.

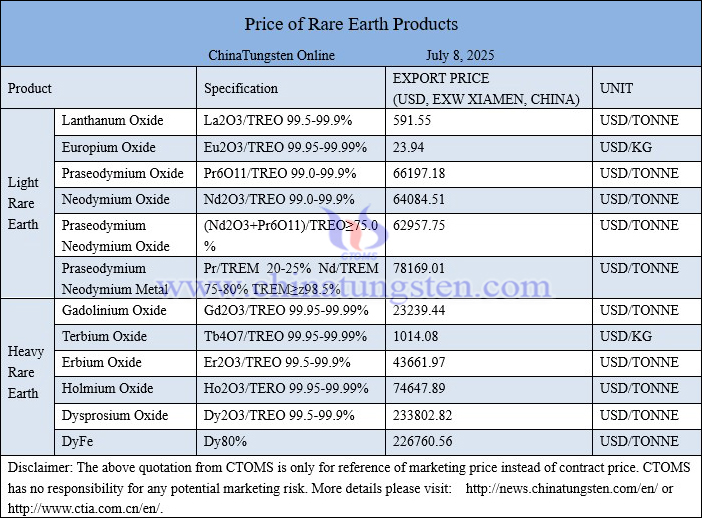

Price of rare earth products on July 8, 2025

Neodymium oxide picture